WE HAVE TAX CREDITS FOR YOU!

Mission: St. Louis has been approved to offer NAP and YOP tax credits for 2024.

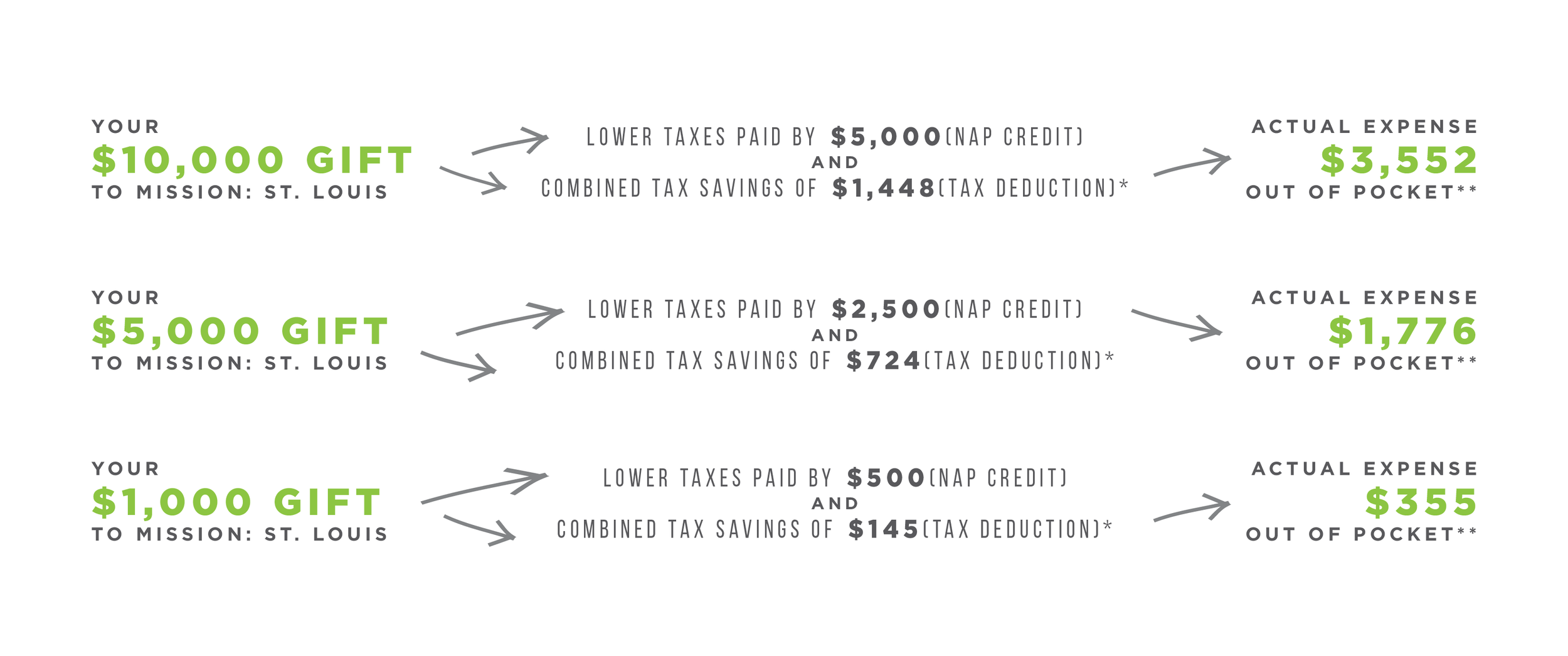

Eligible donors receive a tax credit equaling 50% of your gift to Mission: St. Louis. This credit combines with your federal and state charitable income tax deduction to lower the actual net cost of your gift to cents on the dollar.

WHO QUALIFIES FOR NAP?

Corporations

S-Corporations

Individuals Operating a Farm in Missouri

Individuals Operating a Sole Proprietorship

Individuals with Rental Property in Missouri

LLCs

Partnerships

Express companies

Financial institutions

Insurance companies

WHO QUALIFIES FOR YOP?

Anyone with a Missouri Tax Liability

HOW IT WORKS FOR AN INDIVIDUAL WHO ITEMIZES:

*Combined federal and state savings

** State tax credit may be limited and actual tax rates may vary. Your tax professional will be able to verify your expected tax benefits based on your personal situation. These examples are for illustration purposes only.

With a limited amount of tax credits to be claimed, they will go fast.

Contact Chad at chad@missionstl.org to make a donation and claim your credits!

RECEIVING & USING NAP and YOP TAX CREDITS: HOW DOES IT WORK?

WHAT'S NEXT?

Make your contribution of $1,000+ in cash, stock, property, materials, equipment or supplies to Mission: St. Louis. Donations given through donor advised funds are not accepted (Ie Schwab Charitable Fund). Be sure to indicate your desire to apply for tax credits on your donation (check or online form memo line). We will send you an acknowledgement and brief instructions on how to fill out the tax credit application.

Complete and return the notarized form with proper documentation to: Mission: St. Louis, Attn: Chad Myers • 3108 N Grand Blvd • St. Louis, MO 63107

After receiving your completed form, Mission: St. Louis will mail both the application and proof of donation to the Missouri Department of Economic Development.

You will receive a certification letter directly from the State of Missouri indicating approval within 3-4 weeks, including directions on how to redeem your tax credits.

tax credits renew every year.

For more information contact chad at chad@missionstl.org

Eligible donations can be redeemed or claimed when you file your tax return.

Any remaining tax credit balance can be used during the next five years.

Tax credits are NOT saleable, transferable or refundable. A gift of appreciated securities would provide additional tax benefits related to avoiding capital gains. *The above calculations assume a 38% tax bracket, and that state tax is NOT deductible when calculating federal tax because new tax laws limit the state tax deduction for most individuals. Also the above scenario assumes that the federal tax is NOT deductible for state tax. Finally the above calculations assume that an individual can, in fact, itemize deductions under the new tax laws. This is not intended to represent tax advice. Please consult your tax advisor to learn how tax credits will benefit you specifically.